The alpha Brief: Market Recap

- Henriot Investment Management LLC

- Oct 25, 2025

- 5 min read

Friday capped another eventful week for markets, with major indices touching fresh highs amid easing inflation data. Investors looked past renewed trade tariff threats and focused on signs of cooling price pressures, which bolstered hopes for a Federal Reserve rate cut in the coming days. Below, we break down the key market drivers of the past two weeks and review our portfolio’s performance in a neutral, fact-based summary.

Bulls Shrug Off Tariff Threats

Equity bulls continued their march upward even as the U.S. imposed new tariff threats on Chinese goods. Market sentiment improved on optimism that upcoming trade talks between President Trump and President Xi – set for next week – could yield progress. This optimism, coupled with a better-than-expected inflation report, propelled the S&P 500 and Nasdaq to intraday record highs on Friday.

Latest data showed the Consumer Price Index (CPI) rose just 0.3% in September, slightly below forecasts, with year-over-year inflation cooling to 3.0% for both headline and core measures. This softer inflation print reinforces the case for the Fed to cut interest rates at next week’s policy meeting. Lower inflation and prospects of easing monetary policy provided a tailwind to stocks and outweighed any concern over the new 100% tariffs announced on Chinese imports.

Earnings Seasons

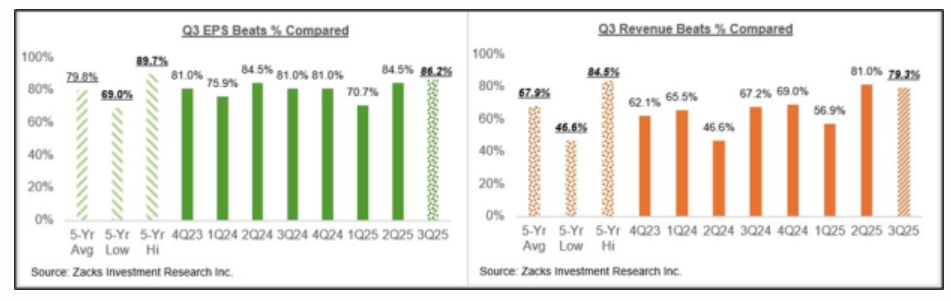

Quarter 3 has also lent support to the market. While Tesla (NASDAQ: TSLA) reported weaker Q3 results – missing profit estimates after the expiration of a key federal EV tax credit – the electric automaker still posted a return to revenue growth, with record vehicle deliveries as buyers rushed to beat the tax incentive’s end. Tesla’s leadership emphasized its strategic focus on autonomous vehicles and robotics, helping allay some growth concerns. More broadly, early earnings reports have been mostly positive, with a majority of S&P 500 companies surpassing earnings and revenue expectations so far. This indicates corporate fundamentals remain solid despite cross-currents like trade tensions.

Gold Sees Sharp Correction

One notable pocket of volatility was in the precious metals market. After trading near all-time highs above $4,300/oz earlier in the month, gold prices plunged over 5% on Tuesday – the steepest one-day drop since 2020. This abrupt correction, which brought gold down to around $4,115/oz, was driven by a combination of profit-taking, a firmer U.S. dollar, and improving investor risk appetite. The dollar’s rise (the DXY index jumped 0.4% that day) made gold more expensive for international buyers, while the midweek risk-on mood reduced demand for safe haven.

Despite the pullback in gold, other traditional havens saw continued buying. The U.S. 10-year Treasury yield actually eased to about 3.97% by Thursday – down from roughly 4.02% the prior week – as investors moved into bonds amid the early-week market jitters. In other words, bond prices rose (yields fell), suggesting that some caution remains even as equities rallied. Analysts note that gold’s longer-term uptrend may remain intact: the fundamental case is supported by record central bank gold purchases and a gradual diversification away from U.S. dollar. Central banks worldwide have been buying gold at a historic pace (over 1,000 tonnes annually in recent years) as they diversify reserves This ongoing demand, combined with gold’s role as a hedge against inflation and currency risk, suggests the current pullback could present a buying opportunity rather than an end to gold’s bull market.

Sector Performance: Energy and Healthcare Shine

Most equity sectors ended the period in the green, with energy stocks leading the pack. Crude oil prices staged a sharp rally after the U.S. announced new sanctions on Russian oil companies Rosneft and Lukoil. This move sparked supply concerns and sent Brent crude surging over 5% on Thursday to around $66 per barrel (the highest since early October) U.S. WTI oil similarly jumped to ~$62. The spike in oil boosted shares of oil producers and refiners, making energy the top-performing sector for the week. Industry analysts noted that if sanctions force major importers like China and India to curtail purchases of Russian oil, it could tighten global supply heading into next year. Energy companies also drew strength from an improved outlook for refining margins, as U.S. diesel prices shot up nearly 7% alongside crude.

The healthcare sector also delivered strong gains, both for the week and month-to-date. Many healthcare firms reported solid earnings results that beat expectations, underpinning the sector’s strength. For example, hospital operator HCA Healthcare raised its profit forecast on robust patient volume, and various pharmaceutical and med-tech companies likewise posted upbeat results. Defensive characteristics of healthcare stocks – such as stable demand and dividends – further attracted investors amid late-October volatility. By contrast, some cyclical sectors lagged. Materials stocks underperformed due to the aforementioned drop in metals prices. Gold mining equities and other metal producers saw short-term pressure from falling commodity prices, even though many had rallied earlier alongside gold’s run-up. On balance, however, the equity market’s tone was positive across most industries thanks to earnings strength and the prospect of easier monetary policy.

Introducing the alpha Brief Portfolio

We’re also excited to share some news on our side. We’ve started the alpha Brief Portfolio, a concise, research‑driven collection of ideas built for thoughtful investors who want signal without the noise. The goal is simple. We aim to surface well‑researched names for long‑term compounding, with clear theses, entry ranges, risk factors, and realistic holding horizons. It will read like a briefing you can act on, not a doorstop report that gathers dust. We’ll weave it into these Friday recaps so you can follow the thinking in real time, and we’ll keep the tone neutral and disciplined because process beats hot takes over a full cycle.

If you’re looking for solid, research-backed stock ideas with real growth potential, check out the alpha Brief Portfolio. It focuses on companies that fit a GARP (Growth at a Reasonable Price) theme, combining data-driven selection with sound fundamentals using our in-house Quant Models. You can follow every move we make, see the companies we’re tracking, and stay aligned with our strategy.

Written by Kennedy NJAGI

Founder, Head of Quant Research & CIO

Important Disclaimer

This article is provided for informational and educational purposes only and should not be construed as an offer, solicitation, or recommendation to buy or sell any securities or investment products. The views and opinions expressed are those of Henriot Investment Management Ltd and do not constitute investment advice or a guarantee of future performance. Investors should conduct their own due diligence or consult a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results. Henriot Investment Management Ltd is not a licensed securities dealer, broker, U.S. investment advisor, or investment bank.

Comments